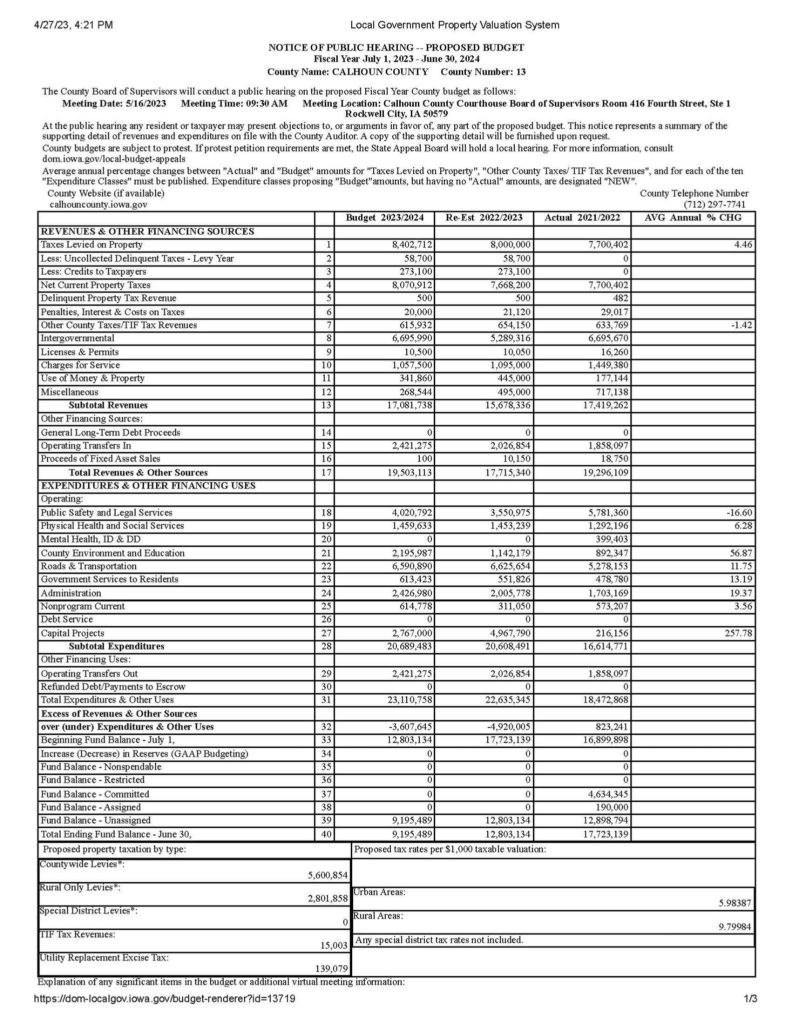

The Calhoun County Board of Supervisors have approved their Fiscal Year (FY) 2024 maximum property tax rates for the county. The county’s urban and rural levies are both down compared to the previous Fiscal Year. FY23’s Urban levy was $6.10 per $1,000 of taxable assessed valuations, and the FY24 rate is $5.98387. The rural levy for FY23 in Calhoun County was $10.05. However, FY24’s rural rate is down 25 cents to $9.79984 per $1,000 of assessed valuations. The county will spend approximately $20.6 million in expenditures in FY24, which is $80,000 more than last Fiscal Year. Total revenue stands at $19.5 million, a $1.7 million increase compared to FY23’s numbers. A copy of the Calhoun County Board of Supervisors budget can be found included with this story on our website.